The Social Security Administration (SSA) offers both Social Security Disability Insurance (SSDI) and Social Security Retirement Insurance (SSR), but not everyone is eligible for both. However, most SSDI recipients won’t see a change in their benefits when they reach full retirement age (FRA), as their benefits program will seamlessly shift from SSDI to SSR.

Benefits Automatically Shift

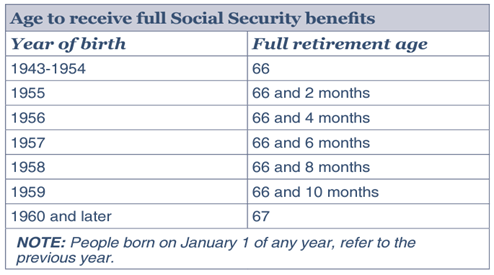

When you reach FRA, Social Security disability benefits automatically change to retirement benefits because the law doesn’t allow a person to receive both benefits on one earnings record concurrently. Still, if you experience disability after filing for retirement benefits before FRA, you may be able to change to SSDI to receive a higher benefit. Similarly, early retirees who belatedly discover an existing condition may have qualified for a higher disability benefit and might be able to claim it retroactively.

Until you reach FRA, you can receive both SSDI and SSR, but the amount of the benefits will be affected. If you receive SSDI, your Social Security retirement benefits may be reduced. It’s important to consider how these benefits may interact before deciding when to start receiving retirement benefits.

Source: SSA

Retroactive Claims

Suppose you began taking your Social Security benefit at age 62. You’ll take a reduction in benefits for filing before full retirement age. Six months later, you receive a kidney disease diagnosis. You can file for SSDI and get a higher benefit backdated to your application for disability, but there is a risk that the claim may not be approved. You still won’t receive full retirement benefits; however, the period of reduced benefits for early retirement will change from four-plus years to when you were eligible for retirement benefits only.

In another example, you may take early retirement benefits at age 62 because your work was no longer compatible with your failing eyesight. Although your physician diagnosed you with macular degeneration, you were unaware this could qualify you for SSDI. You can prove to the SSA that your disability began before you took early retirement. You would qualify to receive retroactive pay for up to 12 months, compensating for the difference between what you have already received from SS and what you would have received under SSDI.

A final more general example is when someone opts for early retirement sometime between age 62 and FRA after an injury or illness causes them to quit working. The goal is to begin receiving early retirement SS benefits to immediately cover bills until the claim for SSDI benefits receives approval and the waiting period for those benefits expires. If they qualify for SSDI, they receive their full retirement benefit even though they initially applied early because SSDI benefits calculations use your FRA.

Ultimately, qualifying for exceptions can be risky since there is no guarantee that you will be eligible for retroactive pay, and it still won’t allow you to collect more than your full retirement benefit.

How SSDI Affects SSR Benefits

The SSA uses a formula to calculate both SSR and SSDI. If a person is receiving both, the SSA will first apply an “offset” formula to determine the amount of the combined benefits a person can receive.

Under the offset formula, the SSA will subtract the SSR benefit from the SSDI benefit, and the person will receive the higher of the two amounts. For example, if the SSDI benefit is higher, the person will receive the full SSDI benefit; if the SSR benefit is higher, the person will receive the difference between the two benefits. It’s important to know the SSA periodically re-evaluates the offset and can adjust benefits accordingly.

SSDI benefits can change over time because, with medical advancements, the SSA may determine that a person is no longer disabled and stop SSDI benefits.

SSDI and SSR Concurrently

There are several exceptions to receiving both SSDI and SSR benefits simultaneously.

- Windfall Elimination Provision (WEP) – If a person receives a pension from a job where they did not pay Social Security taxes, the SSA may reduce their SSDI benefits through WEP.

- Government Pension Offset (GPO) – If a person receives a pension from a government job, the SSA may reduce their spousal or survivor benefits through the GPO.

- Earnings Limit – If a person receiving SSDI has substantial earnings from work, their benefits may be reduced or stopped.

- Trial Work Period (TWP) – If a person receiving SSDI returns to work, they may be eligible for a TWP, during which they can receive full benefits regardless of their earnings.

Getting Help from a Disability Attorney

A disability attorney can help you understand the complex rules and exceptions for receiving SSDI and SSR benefits. Consulting with an attorney is recommended to access the disability benefits your need.

If you apply for SSDI and retirement and don’t receive approval, you may be stuck drawing a smaller amount of SSR for the remainder of your life. You will be entitled to appeal an unfavorable decision but must act within the 60-day window to file your appeal.

However you choose to proceed, you have the right to representation when doing business with the federal agency. Hiring a disability attorney who understands how SSDI works in conjunction with SSR can best protect your interests.

Disability attorneys typically work on a contingency basis and can’t charge a fee without receiving written approval from the SSA. When you receive SSDI approval, your attorney fee will be deducted from your back pay as stipulated by the SSA.

Your lawyer can identify your best option to receive the most benefits possible within the rules and regulations of the SSA. To ensure your benefits are optimized, consult with a disability attorney to fully understand how Social Security calculates a retirement to disability benefit. For legal advice, please contact our Chicago area offices by calling 312-878-0155.